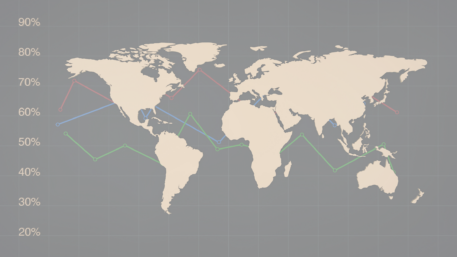

For the first time since October 2020 not a single container ship waited offshore of the ports of Los Angeles or Long Beach on November 22-23, 2022. An American Shipper survey of Marine Traffic ship-position data and port queues showed just 59 container ships waiting off North American ports on November 23, mainly along the East and Gulf coasts as supply chain disruptions seen earlier in the year begin to curtail. As queue lines shrink, ocean freight prices have begun to fall at a break-neck speed with no sign yet of stopping. The Drewry World Container Index showed a 78% decline in the global composite rate between September 16, 2021 and December 1, 2022, while the Drewry Shanghai-Los Angeles index fell 84% over that period and its Shanghai-New York index dropped 73%. Freightos reported a similar trend, with the Freightos Baltic Daily Index China-West Coast assessment plunging 93% between September 5, 2021 and December 1, 2022, while its China-East Coast rate was down 84% over that time and its global composite down 75% as well.

While major shippers reaped in profits in 2021 and early 2022, waning import demand is leading to a negative outlook for 2023. Shipping firm HLS reported to CNBC that trade data shows a decline in Asia imports to the U.S. by 11% from the prior year while U.S. manufacturing orders from China were reported DOWN 40%. As a result, logistic firms are expecting Chinese factories to shut down two weeks earlier than usual for Chinese Lunar New Year (January 21, 2023). Weaker demand and tightening monetary policy in some of the world’s largest economies HLS analysts are predicting a further 2.5% decline in container volumes and a nearly 5-6% increase in capacity in 2023. With ample capacity and lack of demand, prices will likely continue to fall through 2023 as shippers become more competitive with one another for contracts.